16 Dec Canadian home sales edge higher in November

Ottawa, ON, December 16, 2019 – Statistics released today by the Canadian Real Estate Association (CREA) show national home sales continued to edge higher in November 2019.

Highlights:

- National home sales rose 0.6% month-over-month (m-o-m) basis in November.

- Actual (not seasonally adjusted) activity was up 11.3% year-over-year (y-o-y).

- The number of newly listed properties dropped by 2.7% m-o-m.

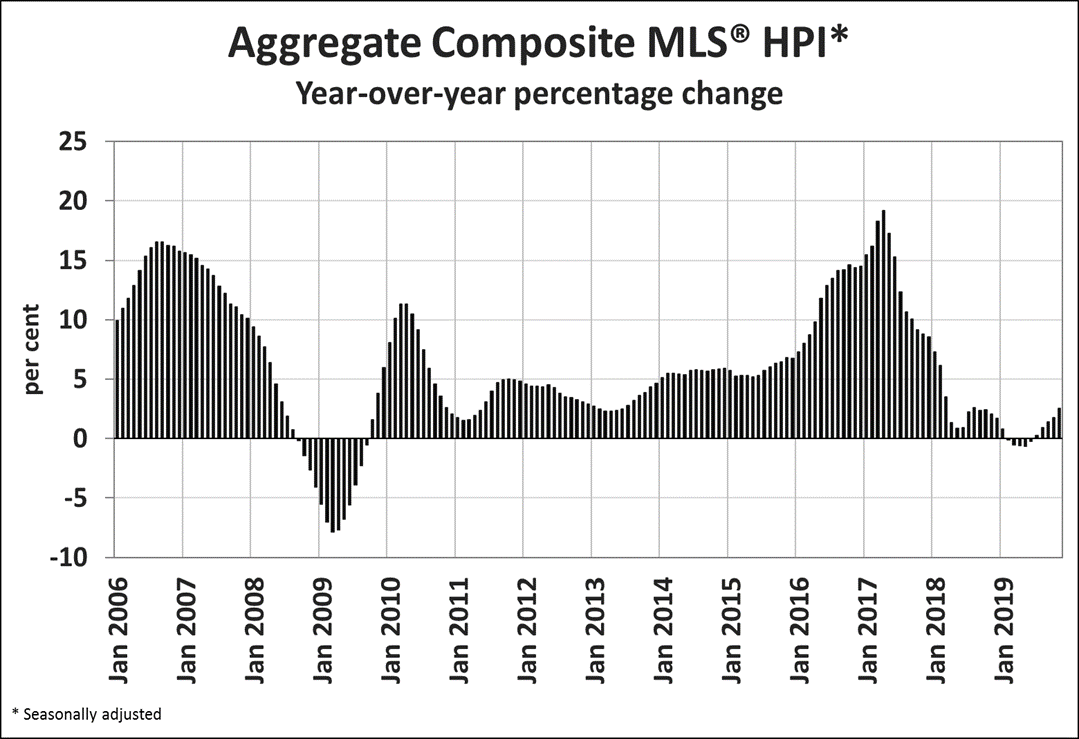

- The MLS® Home Price Index (HPI) advanced by 0.8% m-o-m and 2.6% y-o-y.

- The actual (not seasonally adjusted) national average sale price climbed 8.4% y-o-y.

Home sales recorded via Canadian MLS® Systems inched up by 0.6% November 2019. Notching its ninth straight monthly gain, activity stands 20% above the six-year low reached in February 2019 but 6% to 7% below heights recorded in 2016 and 2017.

Home sales recorded via Canadian MLS® Systems inched up by 0.6% November 2019. Notching its ninth straight monthly gain, activity stands 20% above the six-year low reached in February 2019 but 6% to 7% below heights recorded in 2016 and 2017.

There was an almost even split between the number of local markets where activity rose and those where it declined. Higher sales across much of British Columbia and in the Greater Toronto Area (GTA) offset a decline in activity in Calgary.

Actual (not seasonally adjusted) activity was up 11.3% year-over-year in November. Transactions surpassed year-ago levels in almost all of Canada’s largest urban markets.

“Sales continue to improve in some regions and not so much in others,” said Jason Stephen, president of CREA. “The mortgage stress-test doesn’t help relieve the ongoing shortage of housing in markets where sales have improved, and it continues to hammer housing demand in markets with ample supply. All real estate is local, and nobody knows that better than a professional REALTOR®, your best source for information and guidance when negotiating the sale or purchase of a home,” said Stephen.

“Home prices look set to continue rising in housing markets where sales are recovering amid an ongoing shortage of supply,” said Gregory Klump, CREA’s Chief Economist. “By the same token, home prices will likely continue trending lower in places where there’s a significant overhang of supply, perpetuated in part by the B-20 mortgage stress-test that continues to sideline homebuyers there.”

The number of newly listed homes slid a further 2.7%, putting them among the lowest levels posted in the past decade. November’s decline was driven primarily by fewer new listings in the GTA.

Slightly higher sales and a drop in new listings further tightened the national sales-to-new listings ratio to 66.3%, which is well above the long-term average of 53.7%. If current trends continue, the balance between supply and demand makes further home price gains likely.

Considering the degree and duration to which market balance readings are above or below their long-term averages is the best way of gauging whether local housing market conditions favour buyers or sellers. Market balance measures that are within one standard deviation of their long-term average are generally consistent with balanced market conditions.

Based on a comparison of the sales-to-new listings ratio with the long-term average, just over half of all local markets were in balanced market territory in November. That list includes the GTA and Lower Mainland of British Columbia, but market balance there is tightening. By contrast, an oversupply of homes relative to demand across much of Alberta and Saskatchewan means sales negotiations remain tilted in favour of buyers.

Meanwhile, an ongoing shortage of supply of homes available for purchase across most of Ontario, Quebec and the Maritime provinces means sellers there hold the upper hand in sales negotiations. The number of months of inventory is another important measure of the balance between sales and the supply of listings. It represents how long it would take to liquidate current inventories at the current rate of sales activity.

There were just 4.2 months of inventory on a national basis at the end of November 2019 – the lowest level recorded since the summer of 2007. This measure of market balance has been retreating further below its long-term average of 5.3 months. While still just within balanced market territory, its current reading suggests that sales negotiations are becoming increasingly tilted in favour of sellers.

National measures of market balance continue to mask significant and increasing regional variations. The number of months of inventory has swollen far beyond long-term averages in Prairie provinces and Newfoundland & Labrador, giving homebuyers ample choice in these regions. By contrast, the measure is running well below long-term averages in Ontario, Quebec and Maritime provinces, resulting in increased competition among buyers for listings and providing fertile ground for price gains. The measure is still within balanced market territory in the Lower Mainland of British Columbia but is becoming increasingly tilted in favour of sellers.

The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose 0.8%. Marking its sixth consecutive monthly gain, it now stands almost 4% above its low point reached last May.

The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose 0.8%. Marking its sixth consecutive monthly gain, it now stands almost 4% above its low point reached last May.

The MLS® HPI in November was up from the previous month in 14 of the 18 markets tracked by the index.

Home price trends have generally been stabilizing in the Prairies in recent months.

While that remains the case in Calgary, Edmonton and Saskatoon, prices in Regina have again moved lower. By contrast, home price trends have clearly started to recover in the Lower Mainland of British Columbia. Meanwhile, prices continue to rebound in the Greater Golden Horseshoe (GGH) region while continuing to trend higher in housing markets to the east of it.

Comparing home prices to year-ago levels yields considerable variations across the country, with a mix of gains and declines in western Canada together with price gains in eastern Canada.

The actual (not seasonally adjusted) Aggregate Composite MLS® (HPI) was up 2.6% y-o-y in November 2019, the biggest year-over-year gain since March 2018.

Home prices in Greater Vancouver (-4.6%) and the Fraser Valley (-2.9%) remain below year-ago levels but declines are shrinking. Elsewhere in British Columbia, home prices logged y-o-y increases in the Okanagan Valley (+1.4%), Victoria (+1.5%) and elsewhere on Vancouver Island (+2.8%).

Calgary, Edmonton and Saskatoon posted price declines of around -2% y-o-y, while the gap widened to-5.5% y-o-y in Regina.

In Ontario, price growth has re-accelerated well ahead of overall consumer price inflation across most of the GGH. Meanwhile, price growth in recent years has continued uninterrupted in Ottawa, Montreal and Moncton.

All benchmark home categories tracked by the index accelerated further into positive territory on a y-o-y basis. Two-storey single-family home prices posted the biggest increase, rising 2.8% y-o-y. Price gains were almost as strong for apartment units (+2.6% y-o-y) and one-storey single family homes (+2.5% y o y), while townhouse/row prices climbed a more modest 1.5% compared to November 2018.

The MLS® HPI provides the best way to gauge price trends, because averages are strongly distorted by changes in the mix of sales activity from one month to the next.

The actual (not seasonally adjusted) national average price for homes sold in November 2019 was around $529,000, up 8.4% from the same month last year.

The national average price is heavily skewed by sales in the GVA and GTA, two of Canada’s most active and expensive housing markets. Excluding these two markets from calculations cuts almost $125,000 from the national average price, trimming it to around $404,000 and reducing the year-over-year gain to 6.9%.

– 30 –

PLEASE NOTE: The information contained in this news release combines both major market and national sales information from MLS® Systems from the previous month.

CREA cautions that average price information can be useful in establishing trends over time, but does not indicate actual prices in centres comprised of widely divergent neighbourhoods or account for price differential between geographic areas. Statistical information contained in this report includes all housing types.

MLS® Systems are co-operative marketing systems used only by Canada’s real estate Boards to ensure maximum exposure of properties listed for sale.

The Canadian Real Estate Association (CREA) is one of Canada’s largest single-industry trade associations, representing more than 130,000 REALTORS® working through 90 real estate boards and associations.

Further information can be found at http://crea.ca/statistics.

For more information, please contact:

Pierre Leduc, Media Relations

The Canadian Real Estate Association

Tel.: 613-237-7111 or 613-884-1460